The recent run of soft economic data inspires some pundits to claim that a new recession is brewing. They could be right, but they could just as easily be wrong. Although some numbers published to date have been weaker than expected, a broad profile of economic activity still reflects low recession risk. Near-term projections tell a similar story. From a probability standpoint, betting that a recession has started or is about to start still stacks up as a long shot.

Economic risk could change with the next batch of data, of course, but using the numbers available today strongly implies that the odds are low that an NBER-defined recession is underway, based on reports published through July 18.

Upcoming big-picture data is on track to confirm this analysis. Next week’s preliminary estimate of GDP growth for the second quarter via the Bureau of Economic Analysis is widely expected to show that output accelerated after Q1’s weak 1.4% increase. As I discussed yesterday, Q2 forecasts have been trimmed in recent weeks and most projections now reflect moderate growth of roughly 2%-3% (seasonally adjusted annual rate). But that’s still a respectable pace compared with the average 2% advance in quarterly GDP changes over the past five years.

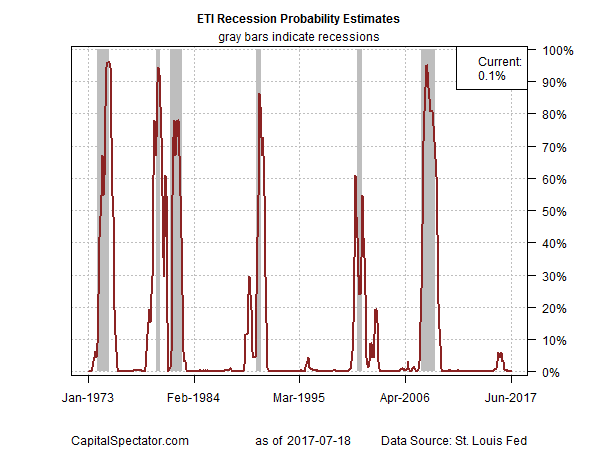

As for recession risk, the probability remains virtually nil that a downturn has started, based on numbers published to date via the Capital Spectator’s proprietary business-cycle indexes. With the first round of data for the June macro profile nearly complete, most indicators continue to reflect a positive trend. As a result, recent reports suggest that there’s enough forward momentum to keep the economy expanding in the immediate future.

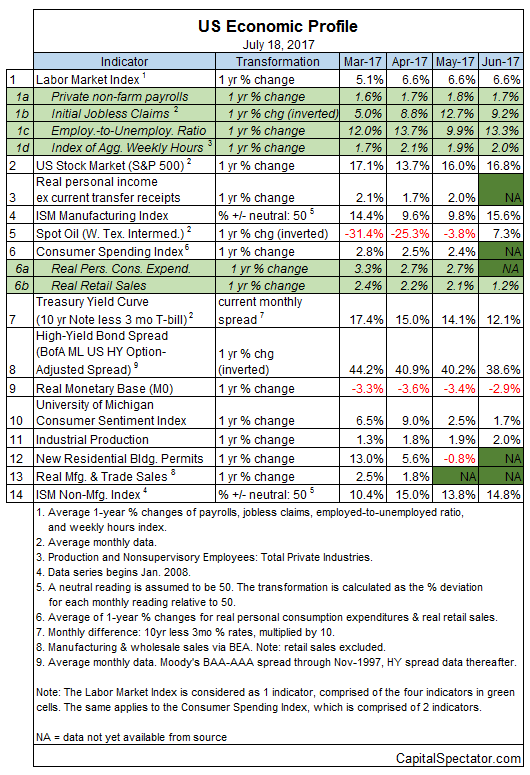

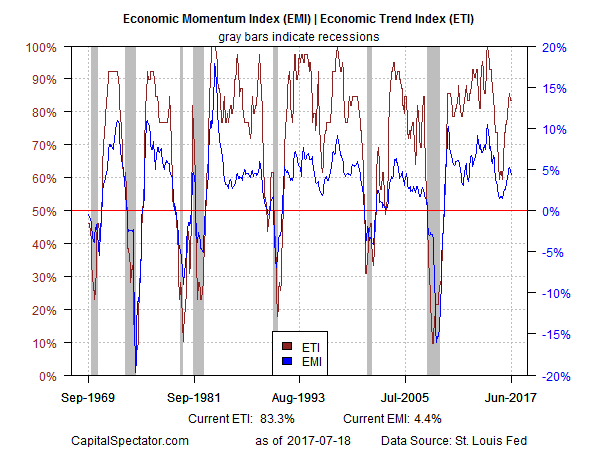

Aggregating the data in the table above continues to a reflect a positive broad trend. The Economic Trend and Momentum indices (ETI and EMI, respectively) have dipped lately, but remain well above their respective danger zones: 50% for ETI and 0% for EMI. When/if the indexes fall below those tipping points, we’ll have clear warning signs that recession risk is elevated and a new downturn is likely. The analysis is based on a methodology that’s profile in my book on monitoring the business cycle.

Translating ETI’s historical values into recession-risk probabilities via a probit model also points to low business-cycle risk for the US through last month. Analyzing the data via this framework indicates that the odds are close to zero that NBER will declare June as the start of a new recession.

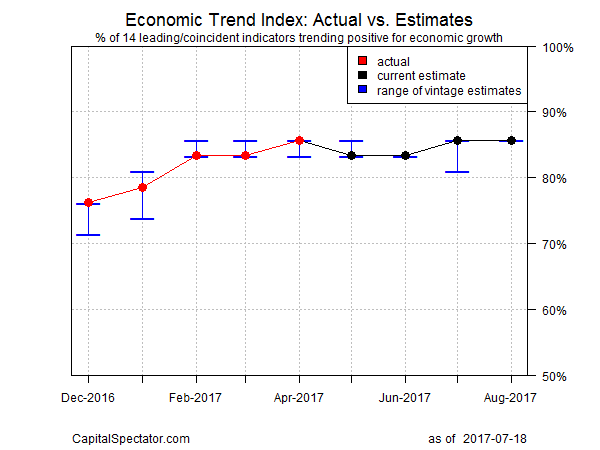

For perspective on what’s in store for the immediate future, consider how ETI may evolve as new data is published. One way to project values for this index is with an econometric technique known as an autoregressive integrated moving average (ARIMA) model, based on calculations via the “forecast” package for R. The ARIMA model calculates the missing data points for each indicator for each month — in this case through August 2017. (Note that April 2017 is currently the latest month with a full set of published data). Based on today’s projections, ETI is expected to remain well above its danger zone in the immediate future.

Forecasts are always suspect, but recent projections of ETI for the near-term future have proven to be reliable guesstimates vs. the full set of published numbers that followed. That’s not surprising, given ETI’s design to capture the broad trend based on multiple indicators. Predicting individual components, by contrast, is prone to greater uncertainty. The assumption here is that while any one forecast for a given indicator will likely be wrong, the errors may cancel out to some degree by aggregating a broad set of predictions. That’s a reasonable view, according to the generally accurate historical record for the ETI forecasts in recent years.

The current projections (the four black dots in the chart above) suggest that the economy will continue to expand. The chart above also includes the range of vintage ETI projections published on these pages in previous months (blue bars), which you can compare with the actual data (red dots) that followed, based on current numbers.